Bahrain Indemnity Calculation

- Article

- Comment (10)

Introduction

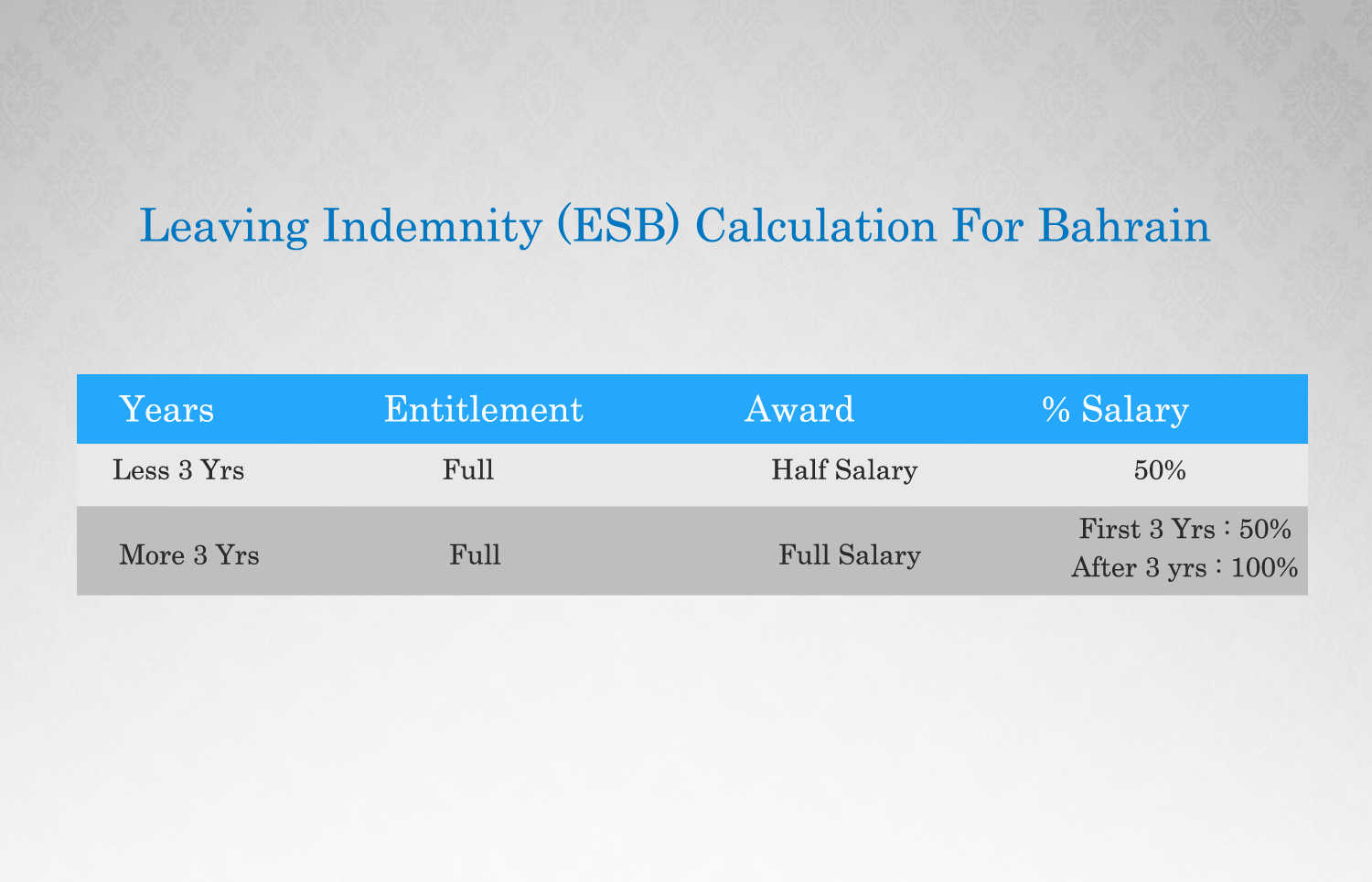

Many confusions and complications while working with a Bahrain based HRM. From my experience and formula I used in my functions, I am sharing here to help others. The leaving Indemnity also called as End of Service Benefit(ESB). So Bahrain Indemnity Calculation is part of the employee payment service, which worked out when an employee resigned or terminated his job by employer. From different sources regarding labour law, I figured out it. It shows something like it calculated first three years 50% of the Salary. After third year, the Indemnity calculated full Salary.

Salary

The Leaving Indemnity calculated from the last salary the employee received during the time of termination. Which means the Last paid salary considered to calculate the ESB or Indemnity. Some information stating that the indemnity calculated only with Basic Salary. But some companies calculates Basic allowance plus Social allowances, if any. And even some companies providing based on the gross salary. So lets consider it as basic Plus Social allowance.

Indemnity Calculation

Calculating the Leaving indemnity is like Payroll calculation.But it works like the period of employee service. Which means the years and months employee worked in a company. It uses the days also to calculate the ESB. So the last paid salary will be used to calculate the ESB. Lets take an example of calculation.

An Employee works for a period of 6 years. and his gross Basic+Social allowance is 700 BD(Bahrain Dinar ).

First Year Half Salary – 350 BD

Second Year Half Salary – 350 BD

Third Year Half Salary – 350 BD

Forth Year Full Salary – 700 BD

Fifth Year Full Salary – 700 BD

Sixth Year Full Salary – 700 BD

So the Total Indemnity will be calculated as 3150 BD. And if the employee works for 6 years and 7 months and 20 days. The Fraction level Calculation should be applied to get his indemnity. That I have made a calculation for demo.

Conclusion

The calculation and the formulas i used to calculate is may not be matching to all companies. So Consider this calculation is an approximate or tentative values. If you guys have any suggestion or improvement, I will adjust and provide the best results in it.

I completed 2 years in one oraganaisation. Yesterday Jan 11 my visa was expired.i resign from the company already Let me know I am eligible for the indemnity.

If you completed two years, its possible to get it. But it depends on the Company. Some companies, they do give if they have minimum of 3 years. But most of the companies in Bahrain, they do provide it for 2 years. Its upto your company, So check with your HR or the person who deals with you. You might have chances to get it.

Dear Sir Good morning,

Hope you are very well…

In fact, what I mean is that I have been working as a team leader in an Italian restaurant (pasta expressed) for six long years & 3month. But the company Terminated me on 14/07/20 without any reason. Now the question is that I joined that company on 27/05/2014. But my visa processing was from 2016, so now how much i can get settelment & indemnty .(please help me )

Thank thanks & best regards…

The calculation what i am showing in the site is purely calculation. But the date differs from company to company. so check with your company HR to know proper details for you.

Please note your calculation is not matching with Bahrain labour law, The Bahrain law saying that the salary which using for calculating indemnity (ESB) of the employee is the basic salary of the employee

I am sorry if its wrong. We created it 3 years back. If you have right and working calculation send it to us. We will update to many people will get benefited with it.

thank you

Greetings sir.

I joined the company in 10-2015. Now I resigned from company. My doubt is does GOSI employee deduction will be calculated along with the basic salary for Gratuity calculation. And will HRA be part of the indemnity calculation. Sorry If am asking wrong details but I had this doubt about GOSI deduction.

Thank you.

Usually, as per the company it differs. But most of the companies provide from Full salary. some companies they are doing from Basic only. So it depends on the company. You need to check with your HR Admin to know more about this facts. Usually this facts, they don’t disclose it.

Hi.

Good morning sir.

I read your article it very helpful. Thanks for it

Here I working in Bahrain (i working in a garage and salry is 250 bd )since December 2014 till yet .now I decide to finish my contract with my company .will i get all my intermittent salary if I’m a mechanic?

hello manpreet singh,

it depends on company and HR. so speak with them, overall, this is the calculation applied. but the fact it varies between companies and hr’s. Kindly speak with them to get it.