FrontAccounting Working with Taxes

- Article

- Comment (2)

Introduction

FrontAccounting Working with Taxes is pretty awesome when you understand clearly. It supports item taxes too. many get confused with Tax setup and implementation.I hope this article will help them to know better with Frontaccounting taxation’s.

Basically the tax is an important part in invoicing. Especially the sales module, which requires common tax or item taxes.Some countries have GST, VAT, and independent Taxation methods. FrontAccounting Supports both taxation and works well with it. All you need to understand it well before getting into the concept. I have read some information and performed some tests to understand it. Based on my understanding, I am giving tutorial here. This will be useful to you.

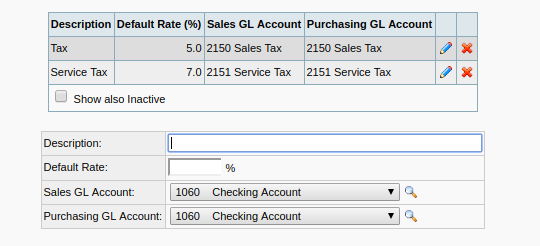

Tax Types

First you have to create taxes.In this to avoid problems with manual journal entry all tax types should have unique Sales/Purchasing GL accounts.you have to give tax name, percentage,Sales GL Account andPurchasing GL Account.Suppose if you are in india mostly two taxes are applicable.one is CGST(Central Goods and Service Tax) another one is SGST(State Goods and Services Tax).WE have to add these taxes with their respective tax percentages.

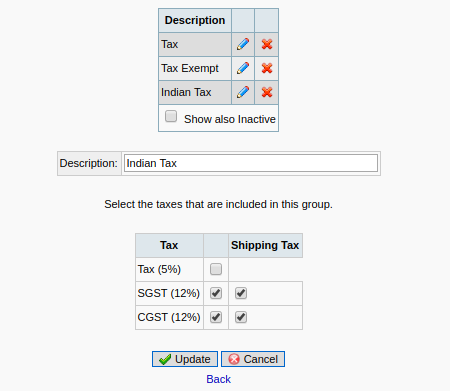

Tax Groups

In tax groups you can create group for different taxes based on your country taxes.Select the taxes that are included in that group and also check whether that taxes included shipping tax or not.Now you create tax groups.Some products have tax free.For that situation you have to create Tax Exempt group.

For example

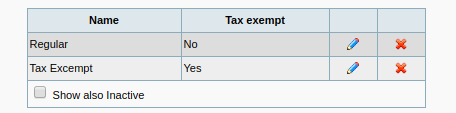

Item Tax Types

Here you can create your tax information as of your country tax types. You can add many tax types based on the product or service you sell to someone else.Each item has its own tax percentage. Say for example, If your country applies GST, the goods has different ratio and service has different ratio of tax. Even each goods has its own tax type. Which differs from product to product. For such a tax part, you can use item tax types to create it.Some products has tax free.For that situation you have to select Is Fully Tax-exempt field to yes .

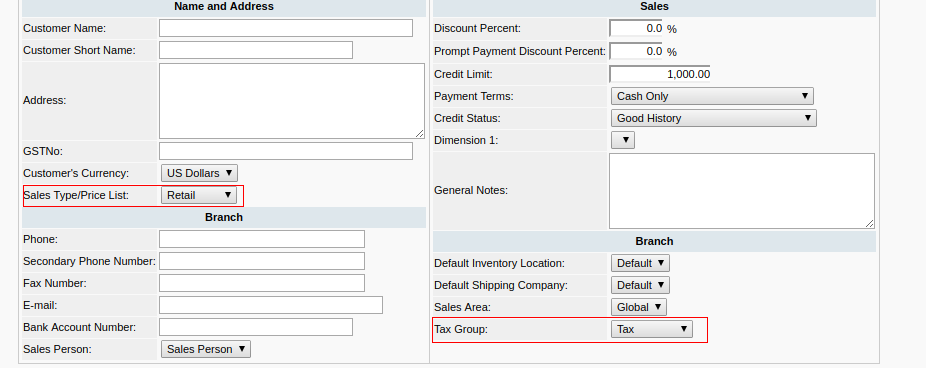

Customers & Suppliers

If you create new customer/supplier you have to select tax group, either you provide full exempt, or partially taxed with a certain percentage or fully taxed with your country Tax rates. That can be defined in the Tax group and here we are selecting the right Tax group to every customers. Also the Sales Type, to define whether the system is included tax or excluded tax. Included Tax and Excluded Tax can be defined within Sales type

I hope it gives you an idea to define the tax types on FrontAccounting system, Hope you will like it. If you have any queries or doubts, you can write it on next tab(Comments tab). I will Assist you further.

Good information.

Thank you Nagaraj.